Stephanie Song, who used to work on the corporate development and ventures team at Coinbase, felt the frustration of having to do a lot of due diligence work every day with her team. She said in an email interview with TechCrunch that “Analysts burn the midnight oil working hundreds of hours doing the work that nobody wants to do,” while funds are looking for ways to reduce their operating costs and make their teams more efficient by investing less.

She wanted to find a better way, and joined hands with Brian Fernandez and Anand Chaturvedi, two former Coinbase coworkers, to start Dili (not to be mistaken for the capital of East Timor), a platform that uses AI to automate essential steps of due diligence and portfolio management for private equity and VC firms. Dili, which graduated from Y Combinator, has raised $3.6 million in venture funding so far from investors like Allianz Strategic Investments, Rebel Fund, Singularity Capital, Corenest, Decacorn, Pioneer Fund, NVO Capital, Amino Capital, Rocketship VC, Hi2 Ventures, Gaingels and Hyper Ventures. Song said that AI impacts every aspect of an investment fund, from analysts to partners and back-office functions.

She also said that fund professionals are looking for a unique edge in decision-making, and can use their data to combine their deal understanding with how it fits into the fund. She thinks that Dili has a unique chance to become a solution for funds in a tough economic situation. Song is right about funds seeking an edge — or any new ways to lower investing risk. VCs have $311 billion in cash reserves, and last year they raised the lowest amount — $67 billion — in seven years as they became more careful about early-stage startups. Dili is not the first to use AI for due diligence. Gartner estimates that by 2025, more than 75% of VC and early-stage investor executive reviews will be based on AI and data analytics.

Several startups and established companies are already using AI to analyze financial documents and large amounts of data to produce market comparisons and reports — such as Wokelo (whose clients are private equity and VC funds, like Dili’s), Ansarada, AlphaSense and Thomson Reuters (through its Clear Adverse Media division).

Song claims that Dili uses “unprecedented” technology.

“[We can] achieve very high precision on specific tasks like extracting financial metrics from large unstructured documents,” she continued. “We’ve developed custom indexing and retrieval pipelines tailored for specific documents to give [our AI] models high quality context.”

Dili uses GenAI, specifically large languages models similar to OpenAI’s ChatGPT, to simplify investor workflows.

The platform first stores a fund’s historical financial data and investment decisions in a knowledge base, and then uses the aforementioned models to automate tasks such as parsing databases of private company data, handling due diligence request lists and searching for obscure figures across the web.

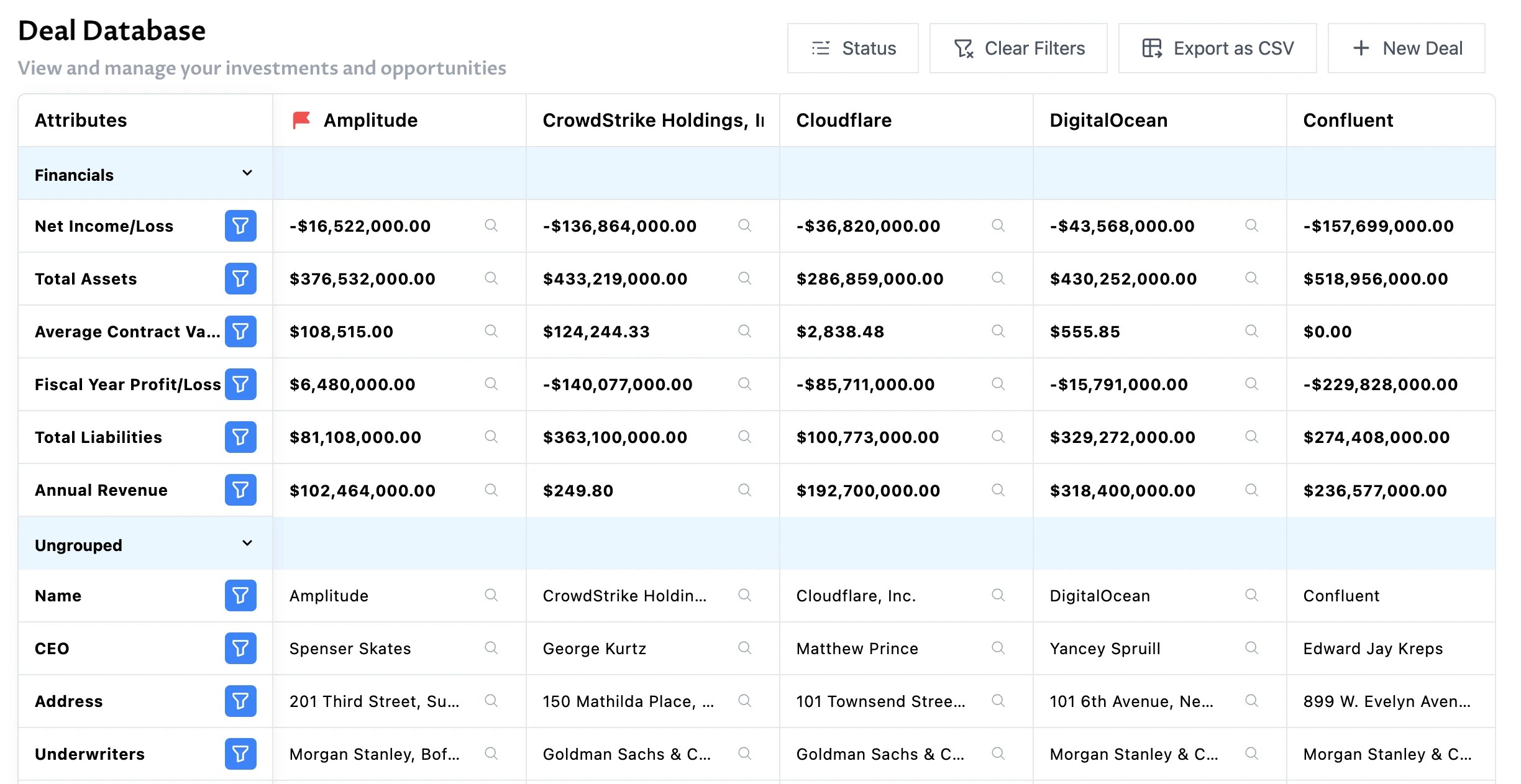

Dili recently added support for automated comparable analysis and industry benchmarking on a firm’s backlog of deals. Once funds upload their deal data, they can compare historical and current investment opportunities in one place.

“Imagine getting an email with a new investment opportunity or portfolio company update and instantly having a platform generate AI-generated deal red flags, competitive analysis, industry benchmarking and a preliminary summary or memo using your fund’s historical investing patterns,” Song said.

The question is, can Dili’s AI — or any AI for that matter — be trusted when it comes to managing a portfolio?

- AI is not always reliable when it comes to facts. Fast Company tested ChatGPT’s ability to summarize articles and found that the model often made mistakes, omitted parts and added details that were not in the articles it summarized. It’s easy to see how this could be a serious issue in due diligence work, where accuracy is essential.

AI can also introduce biases into the decision-making process. In an experiment conducted by Harvard Business Review several years ago, an algorithm trained to make startup investment recommendations was found to favor white entrepreneurs over entrepreneurs of color and preferred investing in startups with male founders. That’s because the public data the algorithm was trained on reflected the fact that fewer women and founders from underrepresented groups tend to face challenges in the funding process — and ultimately raise less venture capital.

Then there’s the fact that some firms might not be willing to run their private, sensitive data through a third-party model.

In a survey from Bloomberg Law, 30% of deal lawyers said they wouldn’t use AI as it exists today at any stage of the due diligence process, citing concerns such as violating confidentiality agreements associated with deals by entering third-party info into AI software. To try to ease all those fears, Song said that Dili is continuing to improve its models — many of which are open source — to lower instances of hallucination and enhance overall accuracy. She also emphasized that private customer data isn’t used to train Dili’s models and that Dili plans to offer a way for funds to create their own models trained on proprietary, offline fund data.

Song said that “While hedge funds and public markets have invested heavily in tech, private market data has a lot of untapped potential that Dili could unlock for firms.” Dili conducted an initial pilot last year with 400 analysts and users across different kinds of funds and banks. As the startup grows its team and adds new capabilities, it’s aiming to expand into new applications — ultimately toward becoming an “end-to-end” solution for investor due diligence and portfolio management, Song says.

“She added that “We believe this core technology we’re building can be applied to all parts of the asset allocation process.”